"13 Tips to secure your child’s future with an Education Policy!"

1. What is an education policy?

An education insurance policy is a life insurance plan designed to help parents save for their child’s education. The plan provides a channel to make regular contributions, to help gradually build funds to support future educational expenses.

2. Why should I consider getting one for my young children?

This policy helps you save for education expenses and provides protection that ensures your child’s education continues uninterrupted in the unfortunate event of a parent’s death.

3. How do the payments of an education policy work?

The benefits are paid out in staggered payments to cater for your child’s school fees at various stages of their education journey e.g. each year of secondary education or each year of university education.

Then at the end of the insurance period the maturity benefits are paid out including all the bonuses earned during the policy.

4. What do I need to know before purchasing an education policy?

a) Evaluate your family plans and the education needs of your children

b) Research on the different policies available

c) Talk to an insurance agent or visit an insurance company to find out policies offers and the terms and conditions for each.

Remember- this is a long-term commitment you will be taking so it is important to find a policy that suits you and your future needs.

5. How do I get an education policy?

An insurance company or agent will issue a proposal form that you fill in with your details.

The insurance company reviews the forms and documents and issues the policy.

You make your first premium payment.

6. What do i need to do when I have an education policy?

Your policy is a contract with the insurance company. Read and understand it.

Make premium payments as per your policy.

7. What do I do if I need to make changes to insurance policy?

Sometimes due to changes in circumstances, it may be necessary to make changes or to policy document. It is advisable to make your request to the company in writing. They will advise on the necessary steps to take to effect the required changes.

8. What happens if I am unable to keep up with my premium payments?

If you're struggling to keep up with premium payments, contact your insurance company immediately to explore available options. Simply stopping payments without communication will cause your policy to lapse. This can be especially detrimental if the lapse occurs within the first three years when the policy hasn't yet gained a surrender value. After three years, there are often solutions to keep the policy active, so it's essential to engage with your insurer promptly to protect your investment.

9. How do I make a claim and how long does it take?

The insurance company should be notified immediately the insured event happens. The necessary forms should be completed and the person making the claim will be advised on the required documents to facilitate processing of a death or disability claim.

In the case of maturity claims, the insurance company will contact you to collect your benefits on or before the maturity date. Contact the company if they do not contact you when your policy matures.

10. What happens if I die before my policy matures?

When taking out an education policy, you’ll need to name beneficiaries who will receive the benefits in case of your untimely demise before the policy matures. These policies often include a clause ensuring partial payouts to support immediate needs while a rider benefit sustains the policy to maturity. This arrangement allows your children to complete their education as originally planned, providing financial continuity even in your absence.

11. Should I cancel my policy?

Buying an education policy is a long-term commitment. If you cancel your policy, you will not receive the total amount of premiums that you have paid to-date, as the surrender value (value of your policy when you terminate it) is usually less than what you have paid. Talk to your insurance company to explore options before cancelling your policy.

12. What is the tax advantage of buying education insurance policy?

A person who has an education insurance policy receives a tax relief of 15% of the premium subject to a maximum of Ksh5,000/- per month or Ksh60,000/- per year. Rates of tax are reviewed from time to time and the tax relief at any one time can be confirmed from the Kenya Revenue Authority.

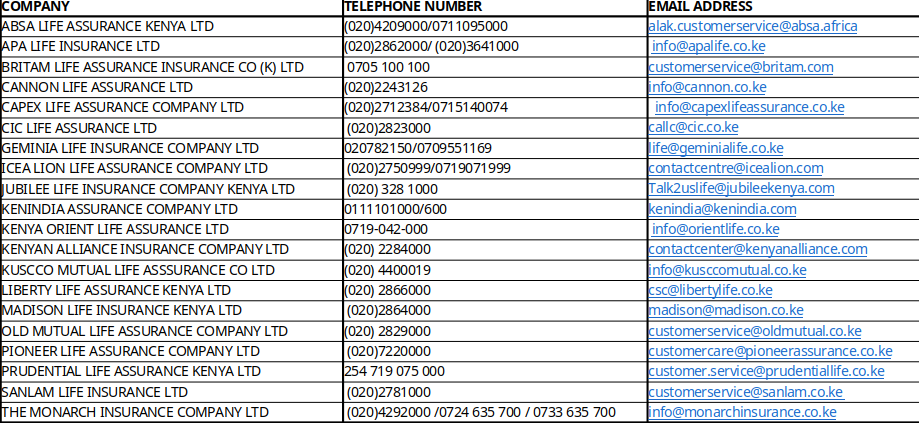

13. Where can I buy an education cover for my child?

Contact any of these Life Insurance Companies to get a policy.